Explore Section 179 Tax Deduction Benefits at Bunnin Chevrolet of Fillmore

Building a business, expanding your fleet, or adding new equipment to your fleet can make taxes a challenge. Thankfully, our team is happy to share details about Section 179 Tax Deductions and Bonus Depreciation, encouraging businesses to reinvest their profits and prepare for the future. Explore key highlights online, or contact us to begin shopping for commercial trucks and vans today.

2025 Section 179 Tax Deduction Overview

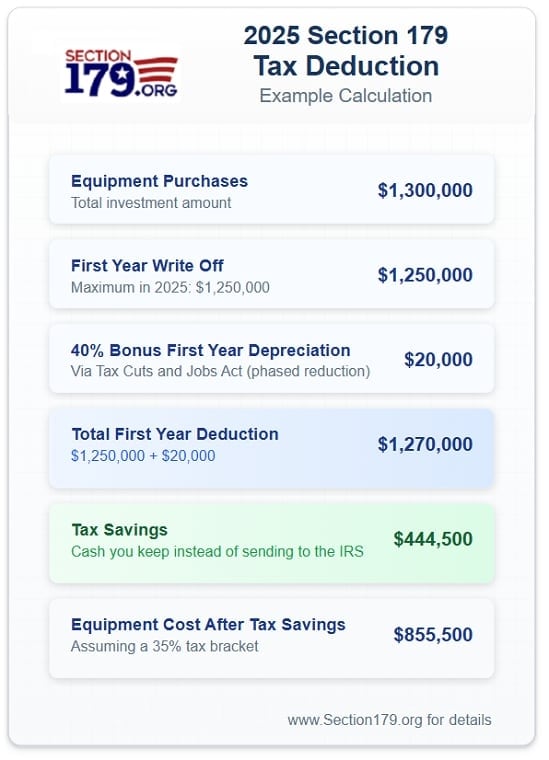

Section 179 deductions can be used to offset the cost of purchasing or leasing vehicles from the taxable income of your business. Limits for 2025 have increased, allowing businesses to maximize their savings and prepare for another year of growth.

Deduction Limit - Up to $2,500,000

The deduction limit is the amount you can spend on a qualifying purchase. Eligible purchases include new and pre-owned equipment, property, accessories, off-the-shelf software, and select vehicles.

Spending Cap - Up to $4,000,000

The spending cap is the total value of all equipment you can purchase to maintain the $2,500,000 deduction limit. After reaching $4,000,000 in total spending, the deduction limit will phase out dollar for dollar.

Bonus Depreciation - 100 Percent

As an additional incentive, bonus depreciation allows you to offset depreciation costs for qualifying vehicles and equipment during your first year of ownership. Bonus depreciation can be taken separately or after Section 179 deductions are applied.

Section 179 Vehicle Deduction Limits

Qualifying vehicles must enter service before December 31st, 2025, and are required to be used for business purposes more than 50 percent of the time. New and pre-owned commercial vehicles with a Gross Vehicle Weight Rating (GVWR) of over 6,000 pounds are eligible for a maximum deduction amount of $31,300. Cars, trucks, or SUVs with a GVWR under 6,000 pounds have a $20,400 first-year deduction maximum.

Section 179 vs. Bonus Depreciation

Bonus depreciation amounts can change from year to year, rising from 40 percent in 2024 to 100 percent in 2025. Previously limited to new equipment, Bonus Depreciation now applies to qualifying new or used equipment, similar to Section 179. For businesses that operate at a net loss or anticipate spending more than the Section 179 Spending Cap of $4,000,000, bonus depreciation provides additional savings on taxable income. Plus, businesses can carry losses into future tax years.

Eligible Chevrolet Trucks & SUVs

Popular vehicles for sale at Bunnin Chevrolet of Fillmore that have a GVWR of 6,000 pounds or more include the:

- Chevrolet Traverse

- Chevrolet Tahoe

- Chevrolet Suburban

- Chevrolet Colorado

- Chevrolet Silverado 1500

- Chevrolet Silverado EV

- Chevrolet Silverado HD

- Chevrolet Silverado HD Chassis Cab

- Chevrolet Low Cab Forward

- Chevrolet BrightDrop

- Chevrolet Express

Contact Bunnin Chevrolet of Fillmore

Ready to learn more about how your business can take advantage of Section 179 and other helpful resources? Our experts are here to understand your operation, listen to your preferences, and build quality solutions that help you succeed. Reach out to our sales team online, over the phone, or in person to receive additional details about new Chevrolet work vehicles today.

How Can We Help?

* Indicates a required field

-

Bunnin Chevrolet of Fillmore

1024 Ventura St

Fillmore, CA 93015

- Sales: (805) 225-6905